The Merc LTFS Login experience is changing the way many people view access to credit and financial tools, especially for Women Entrepreneurs and Rural Entrepreneurs in underserved communities. Through the support of L&T Finance, this Microfinance Platform offers services that bring Financial Accessibility, Inclusive Finance, and Financial Inclusion to individuals and small businesses that were once locked out of formal credit systems.

This guide explains the key services offered by Merc LTFS, how the Loan Application process works, the benefits of the platform, and the role it plays in supporting Women’s Empowerment and Economic Growth. By focusing on real‑world processes like Eligibility Check, Minimal Documentation, and Loan Disbursement, you will get a clear picture of how this Digital Platform supports financial goals step by step.

What is Merc LTFS? Overview of L&T Micro‑Finance

Merc LTFS is a Digital Microfinance platform developed by L&T Finance that aims to provide accessible financial services to individuals and small enterprises. Unlike traditional banking systems, LTFS Merc uses a User‑Friendly Interface and Digital Financial Services to simplify the borrowing process, reduce paperwork, and create direct paths to financial support. The platform is designed as a Lending Platform in which Rural Entrepreneurs, women, and underserved borrowers can connect with lenders using Technology Solutions such as Data Analytics and Machine Learning for Creditworthiness Check.

This Microfinance Platform supports a broad range of financial needs, including Micro Loans, Personal Loans, House Finance, and other tailored solutions. By removing many barriers of conventional lending, Merc LTFS expands Microfinance Access across communities that rarely receive formal loans. Through Digital Lending and Tech‑Enabled Loans, borrowers gain Easy Access to not just financial products, but tools that help with planning, Financial Management, and long‑term economic stability.

Vision and Mission of Merc LTFS Login

The vision of Merc LTFS is to create a lending ecosystem that supports Inclusive Growth by removing traditional barriers to financial support. The mission centers on helping borrowers feel confident in applying for loans, gaining financial resources, and managing their financial goals through a Transparent Process. By prioritizing Women Borrowers and Rural Communities, the platform demonstrates a strategic focus on Women’s Empowerment, Rural Development, and Social Impact.

Merc LTFS Login is more than a portal for accessing credit. It represents a Lending Process that emphasizes simplicity, Transparent Lending, and support for borrowers at every step—from Loan Eligibility to Loan Disbursement and beyond. This mission aligns with broader efforts to expand Financial Inclusion across segments that are underserved and often excluded from mainstream credit.

The Role of L&T Finance in Micro‑Finance

L&T Finance plays a central role in driving Inclusive Finance through its L&T Microfinance initiatives. As a subsidiary of the L&T Group, it brings experience in scaling financial services and integrating modern technology into credit systems. This support helps transform Small Business Loans into practical instruments for economic growth.

By combining Digital Platform capabilities with strategic partnerships and Capacity Building efforts, L&T Finance has strengthened the Lending Platform under Merc LTFS. The platform helps improve Borrower Confidence through Affordable Finance, Loan Guidelines that are easy to follow, and Field Verification that respects borrowers’ time.

Through consistent Community Engagement and visibility in Rural Lending, L&T Finance fosters trust among borrowers and lenders, creating expanded opportunities for Business Expansion, Economic Opportunities, and Financial Resources in areas where traditional systems have limited reach.

Benefits of Merc LTFS for Borrowers and Businesses

Merc LTFS delivers meaningful benefits for both individuals seeking loans and organizations managing lending portfolios. For borrowers, the platform offers Accessible Loans with minimal barriers, such as Minimal Documentation and a Creditworthiness Check that uses advanced methods like Alternative Data. This means applicants with limited credit history can still qualify for support.

For businesses and lenders, LTFS Merc provides efficient Loan Processing and Lender Management tools that help track loan performance and reduce risks. By using Tech‑Driven Insights and Data Analytics, the platform can help lenders make more informed decisions while providing Borrower Support that builds long‑term trust. Merc LTFS serves as a bridge between lenders who seek Investment Opportunities and borrowers who need financial support.

The benefits extend beyond quick access to credit. Borrowers gain opportunities for Financial Planning, Financial Literacy, and Sustainable Income, laying the groundwork for stronger family finances and community stability. This approach aligns financial support with long‑term personal and professional goals.

How Merc LTFS Empowers Women Financially

The goal of Merc LTFS is to provide women with lasting access to financial tools that promote independence, economic participation, and leadership in both business and community. By focusing on female borrowers, the platform helps create environments where women are empowered through clear financial pathways. The combination of financial support and Empowerment Programs brings strategic benefits that can affect entire households and Community Development.

Economic Empowerment

Economic empowerment through Merc LTFS enables women to pursue Business Ownership, grow income sources, and invest in the future. Financially empowered women are more likely to make decisions that benefit their families’ health, education, and well-being. By gaining access to Low‑Interest Loans and Personalized Loans, women can start or grow businesses, access Business Loans, and play leadership roles in local markets. This economic agency boosts confidence and helps many women gain a stronger footing in financial planning.

Community Development

As women move into leadership roles in business, families, and community activities, the positive effects spread beyond individual households. Community Engagement increases because women reinvest income into neighborhood needs, schools, and community services. By supporting women’s success through loan programs like Merc LTFS, local economies become more resilient, and social networks become more supportive and interconnected.

Sustainability & Long‑Term Growth

Programs like Merc LTFS help foster stability that extends across years. When women succeed in their ventures, they create more employment, generate repeat customers, and strengthen local industries. These efforts contribute to broader Economic Growth and Social Development, reinforcing the value of inclusive finance for lasting impact.

Products and Services Offered by Merc LTFS

Merc LTFS offers a wide range of financial products designed to meet many needs. Whether a borrower wants support for housing, business capital, personal expenses, or equipment, the platform has solutions that fit those goals. Each product is tailored to fit specific financial circumstances and increase access in ways that work for each individual or business.

House Finance

House Finance under Merc LTFS gives borrowers support for purchasing, building, or upgrading a home. These loans help families gain stability and a place they can truly call their own.

Personal Loans

Personal Loans through the Loan Portal allow borrowers to handle emergency expenses, health costs, or family needs without stress. These easily accessible loans give financial space when unexpected costs arise.

Two‑Wheeler Finance by Miflow LTFS

Two‑Wheeler Finance gives borrowers the chance to get reliable transport, which can enhance mobility, open work opportunities, and provide easier access to services.

Farm Equipment Finance

Farm Equipment Finance supports farmers who want to invest in tools that improve crop yield, reduce manual labor, and increase earnings. These loans boost productivity for rural families and help strengthen rural economies.

SME Loans

SME Loans through Merc LTFS support Small Business Loans that expand operations, buy inventory, or hire staff. These loans help business owners scale up activities that contribute to local economic activity.

Rural Business Finance

Rural Business Finance focuses on supporting Rural Entrepreneurs with loans designed to meet the challenges of small enterprises in less‑served areas. These loans help grow local markets and strengthen community businesses.

Insurance Products

Merc LTFS also offers important insurance products that help protect borrowers’ futures and financial well-being.

Life Insurance

Life Insurance gives families protection and peace of mind in the event of sudden loss, helping them pay bills and meet long‑term needs with stability.

Health Insurance

Health Insurance helps cover medical costs, reducing financial stress for individuals and families when facing health emergencies.

General Insurance

General Insurance protects personal assets from damage or loss, such as vehicles or property, saving money and maintaining financial strength.

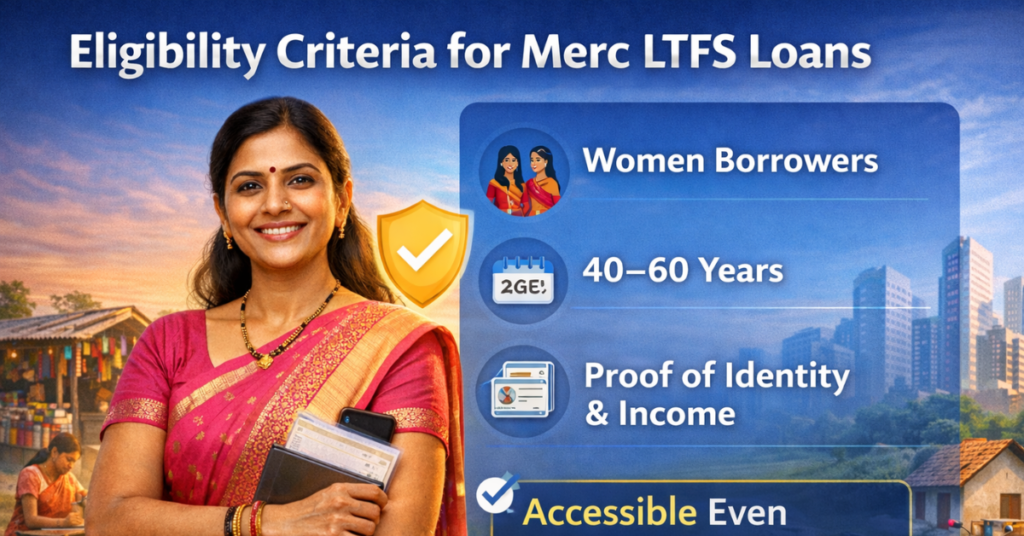

Eligibility Criteria for Merc LTFS Loans

The Loan Eligibility criteria for Merc LTFS loans are intentionally designed to be accessible, even for borrowers without formal credit histories. Applicants must meet basic requirements that reflect Inclusive Platform goals and provide proof of identity and income for a smooth process.

Customer Segments: Women Borrowers

Merc LTFS prioritizes Women Borrowers to help expand Women‑Focused Finance and increase financial access for groups historically overlooked by traditional lenders. This support helps expand economic roles and supports long‑term financial independence.

Age Criteria: 40–60 Years

The standard age criterion helps ensure that borrowers have the maturity and experience needed to manage their financial commitments responsibly, whether for personal needs or business ventures.

Step‑by‑Step Merc LTFS Login & Loan Application Guide

The Merc LTFS Login and application process aims to be straightforward and transparent. With the right steps, applicants can complete the process entirely through a Digital Platform, from registration to submission.

Step 1: Visit the Merc LTFS Login Page

Begin by accessing the official Merc LTFS Login portal using your browser. The platform provides a safe entry point to apply for loans and view product details.

Step 2: Log In to Your Account

Enter your account credentials or register if you are a new user. The process is designed to be simple while offering a secure connection to your financial information.

Step 3: Complete the Application Form

Fill in your personal and financial details accurately. Attach documents that help confirm identity and eligibility. This step works alongside the Credit Assessment process maintained by the platform.

Step 4: Submit and Track Your Application

Once you submit your information, the platform guides you through the Loan Processing. You can monitor the application status through your dashboard and receive updates on important changes.

Required Documentation for Merc LTFS Loans

To make the loan process effective, Merc LTFS requires essential documents such as identification proof, address verification, and income statements. A clear set of documents helps complete the Field Verification process faster and provide accurate Credit Assessment.

Tips to Avoid Common Mistakes During Application

When applying through Merc LTFS, make sure that your information matches your documents, your contact details are current, and your application is complete before submitting. These steps help reduce delays and help you move forward with approval.

Microloans and Their Impacts

Microloans have a measurable impact on families and communities. By providing smaller credit amounts with Affordable Finance options, many borrowers can pursue goals that were previously outside their reach. These loans help households manage expenses and support Economic Opportunities that strengthen their long‑term prospects.

Financial Independence

Microloansgive borrowers the ability to start small businesses, support education costs, and invest in family well-being. For many, this means escaping cycles of debt and gaining a stronger financial footing.

Social Impact

The presence of microfinance services in rural and underserved areas brings broader Social Development benefits. Families can afford healthcare, education, and secure housing, which improves overall quality of life and opportunity.

Case Studies: Success Stories of Merc LTFS Users

Every success story reflects how Merc LTFS helped someone improve their situation. From women who expanded home businesses to farmers who increased yields with new equipment, the platform’s influence appears in every story of growth. These examples show how financial access can transform lives, businesses, and communities.

Future of Merc LTFS and Its Impact on the Micro‑Finance Industry

As technology continues to shape financial services, Merc LTFS remains positioned for growth. With enhancements in Digital Microfinance tools, more people can benefit from Smart Collaboration between borrowers and lenders. This broader adoption of digital tools supports Economic Growth, Rural Lending, and wider access to financial support that was once difficult to secure.

For more insights and expert advice on trading, investing, and money management, visit our finance articles and start reading today.

Frequently Asked Questions (FAQs)

What is Merc LTFS Login?

Merc LTFS Login is the official portal of L&T Finance that allows borrowers, especially women and rural entrepreneurs, to access Micro Loans, track their applications, and manage Financial Services easily through a secure Digital Platform.

Who can apply for loans using Merc LTFS?

Women borrowers and Rural Entrepreneurs within the age range of 40–60 years can apply for House Finance, Personal Loans, SME Loans, and other financial products offered through Merc LTFS.

What types of loans are offered by Merc LTFS?

Merc LTFS offers Micro Loans, House Finance, Personal Loans, Two-Wheeler Finance, Farm Equipment Finance, SME Loans, Rural Business Loans, and Insurance Products, including Life, Health, and General Insurance.

How can I check my loan eligibility on Merc LTFS?

The portal provides an Eligibility Check feature that uses Data Analytics and Credit Assessment to determine your loan amount based on income, existing loans, and repayment capacity.

What documents are required for Merc LTFS loans?

Basic documents include Aadhaar Card, Ration Card, and Income Proof. Minimal Documentation ensures easy access and speeds up the Loan Application and Loan Disbursement process.

How does Merc LTFS empower women financially?

By providing Low-Interest Loans, Business Loans, and Personalized Loans, Merc LTFS enables women to start or expand businesses, build Financial Independence, and support Community Development.

How long does it take for loan approval?

After submitting the required documents, completing Field Verification, and passing the Eligibility Check, loans can be approved in a few days, making Digital Lending fast and efficient.

Is Merc LTFS a safe platform for digital loans?

Yes, the platform ensures Transparent Lending, Cashless Transactions, and uses secure technology to protect borrower information, giving Borrower Confidence in every step.

Can I manage my loan online after approval?

Yes, through Merc LTFS Login, borrowers can track Loan Management, monitor repayments, and receive Personalized Advice for Financial Planning and Business Expansion.

What is the interest rate for Merc LTFS loans?

Interest rates vary depending on the loan type and tenure. Low-Interest Loans are provided for women and rural entrepreneurs to ensure Affordable Finance and sustainable income.

How does Merc LTFS support rural communities?

By providing Rural Business Loans, Microfinance Technology, and Capacity Building, Merc LTFS promotes Economic Growth, Rural Development, and strengthens Community Relationships.

What is Field Verification in Merc LTFS loans?

Field Verification is a step where a representative visits the borrower’s location to confirm details provided in the Loan Application, ensuring a Transparent Process and accurate Credit Assessment.

Can I apply for multiple loan types at the same time?

Answer: Yes, borrowers can apply for different Personalized LLoans, such as SME Loans and Farm Equipment Finance, through the same Loan Portal, allowing flexibility in financial planning.

How does Merc LTFS help lenders manage risk?

Lenders benefit from Tech-Driven Insights, Data Analytics, and Machine Learning models to evaluate borrowers’ creditworthiness and reduce defaults, supporting a healthy Financial Portfolio.

Are there success stories of Merc LTFS users?

Yes, many Women Entrepreneurs and rural borrowers have expanded businesses, increased income, and achieved Financial Independence through Merc LTFS, showcasing the platform’s Social Impact and Grassroots Business support.

Conclusion: Make a Wise Finance Plan with Merc LTFS

Merc LTFS provides a Loan Program that supports financial growth for individuals, families, and small businesses. By offering a range of services—starting with Merc LTFS Login—and prioritizing simple, transparent access to loans, the platform encourages financial independence and healthier financial planning. Whether for purchasing a home, expanding a business, or meeting essential needs, L&T Services through Merc LTFS gives many people a reliable partner for achieving financial goals and building stronger communities.

Disclaimer:

“This article is for educational purposes only and provides general information about Merc LTFS Login and L&T Finance services. It does not constitute personal financial advice. Readers should carefully review loan terms and consult professionals before making financial decisions.”

For more insights on startups, technology, and innovation trends, explore iZoneMedia360 to stay updated and informed.